Meta Description:

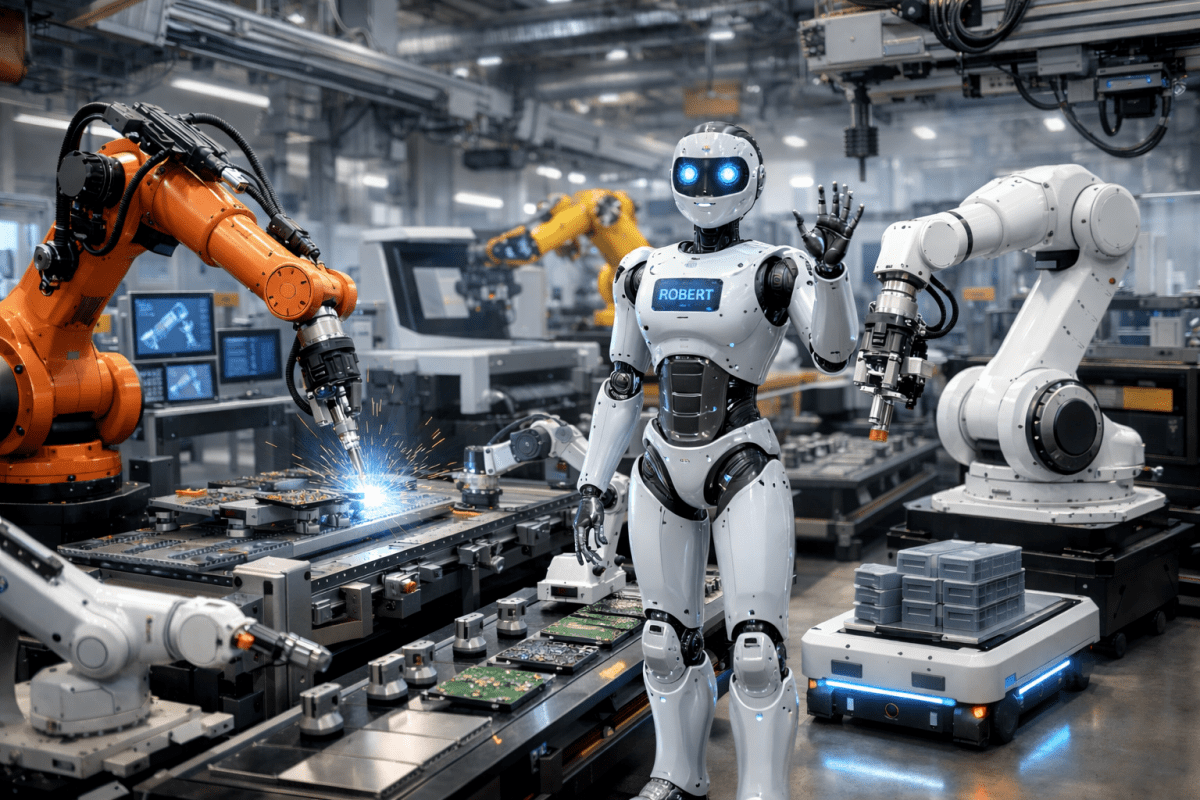

The Industrial Robotics and Automation global landscape of manufacturing and logistics is currently undergoing a seismic shift, driven by the rapid evolution of Automation No longer confined to heavy automotive assembly lines, these technologies have become the backbone of modern industry, influencing everything from the way we package food to how intricate electronics are assembled.

By 2026, the Industrial Robotics and Automation market is projected to reach approximately $233.6 billion, signaling a transition from “early adoption” to “essential infrastructure.” This article explores the current state, technological drivers, and the future trajectory of industrial robotics and automation.

Contents

History of Automation: From Industrial Revolution to AI.

Defining the Core: Industrial Robotics vs. Automation

While the terms are often used interchangeably, they represent two distinct pillars of the modern factory.

Industrial Automation: This is the broader umbrella. It refers to the use of control systems (such as PLCs, SCADA, and DCS) and information technologies to handle various processes and machineries in an industry. The goal is to replace human intervention in repetitive, data-heavy, or dangerous tasks.

Industrial Robotics: This is a subset of automation. It involves the physical deployment of programmable, multifunctional manipulators—robots—to perform tasks. A robot is an “actor” within an automated system.

Together, they create a Cyber-Physical System (CPS) where software intelligence meets physical execution.

The Technological Drivers of 2026

The current surge in adoption is not merely due to the availability of “arms,” but rather the “brains” and “senses” now integrated into them.

A. AI-Native Autonomy and Generative AI

Artificial Intelligence has moved from being a “bolt-on” feature to a core component. Generative AI is now being used to write robot code, allowing engineers to describe a task in natural language, which the system then translates into precise motor movements. This reduces the “barrier to entry” for companies without deep programming expertise.

B. The Rise of Collaborative Robots (Cobots)

Cobots are designed to work alongside human employees without the need for safety cages. Equipped with advanced force-torque sensors and vision systems, they can detect a human touch and stop instantly.

Market Growth: The cobot segment is expected to grow at a 27.5% CAGR through 2030, far outpacing traditional industrial robots.

Use Cases: Small-parts assembly, quality inspection, and machine tending.

C. Autonomous Mobile Robots (AMRs)

Industrial Robotics and Automation Guided Vehicles (AGVs) that required floor wires or magnets, AMRs use LiDAR and SLAM (Simultaneous Localization and Mapping) to navigate dynamic environments. They are the primary drivers of warehouse automation, moving goods without human intervention.

D. Digital Twins and Edge Computing

Before a robot is ever placed on the factory floor, it exists as a Digital Twin—a perfect virtual replica. This allows for:

Predictive Maintenance: Analyzing data at the “Edge” (on the machine itself) to predict a failure before it happens.

Virtual Commissioning: Testing the entire production line in a digital environment to eliminate bottlenecks.

Major Global Players and Market Leaders

The “Big Four” of robotics continue to dominate, but the landscape is fragmenting as specialized startups emerge.

| Company | Specialty | Notable Innovation |

| FANUC | Large-scale assembly | High-payload articulated robots and CNC systems. |

| ABB | Collaborative solutions | The YuMi dual-arm cobot for small-parts assembly. |

| Yaskawa | Welding & Motion control | The Motoman series, known for speed and reliability. |

| KUKA | Automotive & Aerospace | Industry 4.0 integrated controllers and heavy-lift arms. |

| Teradyne (Universal Robots) | Cobots | The global leader in easy-to-deploy collaborative arms. |

Key Applications Across Industries

Industrial robotics and automation are no longer a “one-size-fits-all” solution. Different sectors utilize these technologies in specialized ways:

Automotive

The pioneer of the industry, automotive plants now use robots for 3D vision-guided bin picking, high-speed painting, and complex welding. Modern plants are achieving “lights-out” manufacturing, where production continues without human presence.

Electronics & Semiconductors

As components shrink, the demand for High-Precision SCARA (Selective Compliance Assembly Robot Arm) robots has spiked. These robots can place components with micron-level accuracy at speeds impossible for humans.

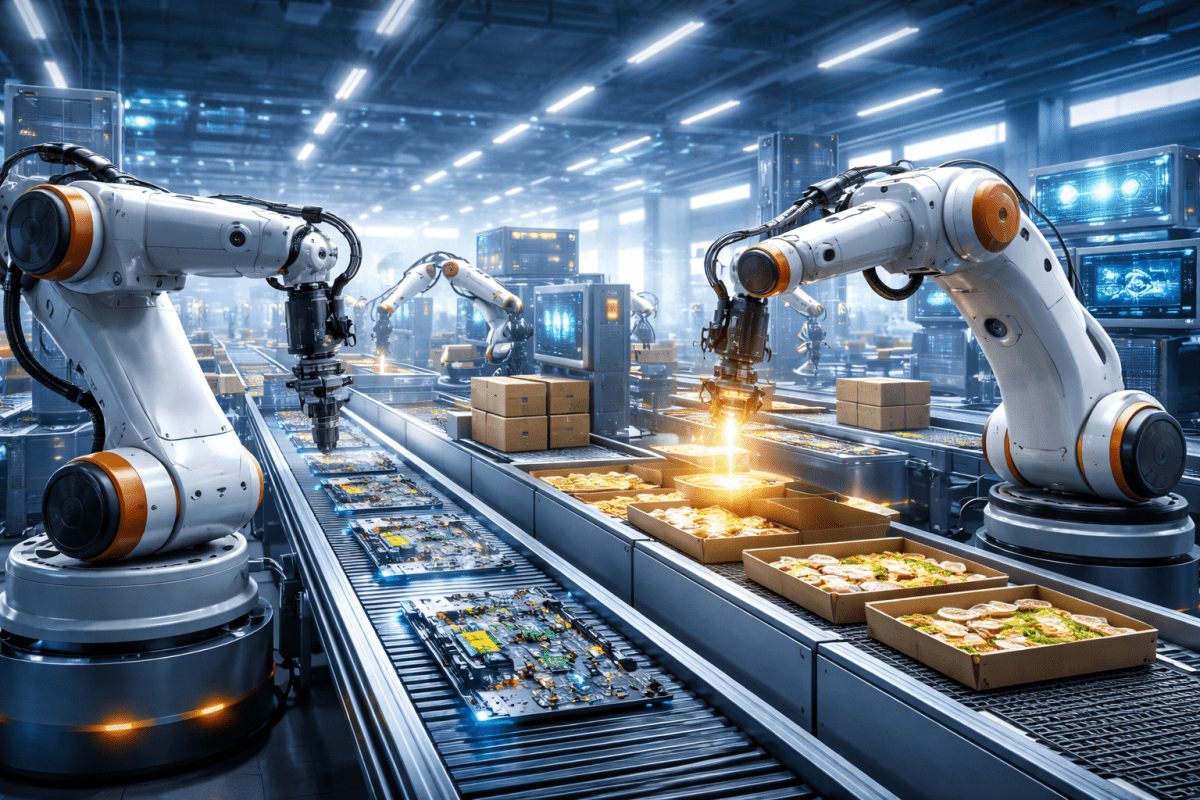

Food and Beverage

Automation in this sector focuses on Hygienic Design. Robots with stainless steel bodies and food-grade lubricants handle “pick and place” tasks, sorting produce, and packaging ready-to-eat meals while maintaining strict safety standards.

Logistics and E-commerce

With the “Amazon effect” driving demand for faster delivery, logistics companies are deploying Robotic Picking Systems that use AI to identify and grab thousands of different items from bins, a task that was once exclusively human.

Overcoming the Challenges of Implementation

While the benefits are clear, the path to a fully automated facility is paved with hurdles:

High Initial Capex: The upfront cost of hardware, software, and integration remains high for SMEs. However, the emergence of Robot-as-a-Service (RaaS) models is allowing companies to lease robots, shifting costs from Capex to Opex.

The Skills Gap: There is a critical shortage of technicians capable of maintaining and programming advanced robotic systems.

Integration Complexity: Connecting new robots with “legacy systems” (old machinery) often requires custom-built middleware and significant engineering time.

The Future: Towards Industry 5.0

If Industry 4.0 was about connectivity and “smart” machines, Industry 5.0 is about the human-robot synergy. It prioritizes the well-being of the worker and the sustainability of the process.

Humanoid Robots: Companies like Figure and Tesla (Optimous) are testing bipedal robots that can walk into a factory designed for humans and perform tasks using existing tools.

Sustainability: Modern automation is being used to optimize energy consumption and reduce material waste, helping companies meet their ESG (Environmental, Social, and Governance) goals.

Strategic Recommendations for Businesses

For companies looking to scale their industrial robotics and automation efforts, the following steps are recommended:

Start Small, Scale Fast: Don’t automate the entire plant at once. Identify a “low-risk, high-impact” use case, such as end-of-line palletizing, to prove ROI.

Focus on Interoperability: Ensure that the systems you buy today can “talk” to the systems you might buy in five years.

Invest in People: Automation doesn’t replace workers; it changes their roles. Training employees to become “Robot Supervisors” is essential for long-term success.

What Is an Industrial Robotics and Automation Company?

An industrial robotics and automation company designs, manufactures, integrates, and supports automated systems used in industrial environments. These systems typically combine:

Industrial robots (robotic arms, mobile robots, collaborative robots)

Controllers and drives

Sensors and vision systems

Software and programming tools

Integrated automation cells and production lines

The primary goal of these companies is to replace or enhance repetitive, dangerous, or precision-critical tasks with automated solutions that improve productivity, quality, and workplace safety.

Unlike consumer robotics, industrial robotics is built for reliability, accuracy, and continuous operation—often running 24/7 in demanding environments such as factories, warehouses, and processing plants.

The Role of Industrial Robots in Manufacturing

Industrial robots are programmable machines capable of performing complex tasks with speed and precision. They are typically mounted on factory floors, walls, or ceilings and operate within defined workspaces.

Common Industrial Robotics and Automation Applications

Industrial robotics and automation companies develop robots for a wide range of tasks, including:

Welding: Spot welding and arc welding in automotive and heavy manufacturing

Assembly: High-precision assembly of electronics, appliances, and mechanical components

Material Handling: Picking, placing, sorting, and transferring parts between processes

Palletizing and Depalletizing: Stacking and unstacking products for shipping

Painting and Coating: Consistent application of paint or coatings in controlled environments

Machine Tending: Loading and unloading CNC machines, presses, and molding equipment

Inspection and Quality Control: Vision-based systems for defect detection and measurement

These applications reduce human exposure to hazardous conditions while ensuring consistent quality at scale.

Automation Systems Beyond Robots

While robots are the most visible part of Industrial Robotics and Automation deliver far more than robotic arms alone.

Control Systems and Drives

Advanced controllers act as the “brain” of automated systems, coordinating robot motion, conveyor systems, sensors, and safety devices. Servo drives and motors ensure precise movement, energy efficiency, and synchronized operation across the production line.

Sensors and Machine Vision

Sensors provide real-time feedback on position, force, temperature, and proximity. Vision systems allow robots to “see,” enabling tasks such as object recognition, alignment, inspection, and adaptive handling of variable parts.

Software and Programming

Automation software enables engineers to program robots, simulate production lines, optimize workflows, and monitor system performance. Modern platforms support:

Offline programming

Digital twins

Predictive maintenance

Remote monitoring and diagnostics

Why Manufacturers Invest in Automation

The demand for industrial robotics and automation has grown rapidly due to several converging factors.

Increased Productivity

Automated systems operate faster and more consistently than manual labor. Robots do not tire, take breaks, or lose concentration, allowing manufacturers to increase output while maintaining quality.

Improved Quality and Consistency

Robots perform tasks with repeatable precision, reducing defects and variability. This is especially critical in industries such as automotive, electronics, and medical device manufacturing.

Worker Safety

Automation removes humans from hazardous tasks involving heavy lifting, high temperatures, toxic materials, or repetitive motions. This leads to fewer workplace injuries and better long-term health outcomes.

Labor Shortages

Many regions face skilled labor shortages, particularly in manufacturing. Automation helps companies maintain production levels even when hiring becomes difficult.

Cost Efficiency Over Time

While initial automation investments can be significant, long-term savings from reduced scrap, lower injury rates, higher throughput, and optimized energy use often justify the cost.

Industries Served byIndustrial Robotics and Automation

Industrial robotics and automation companies serve a wide range of sectors, each with unique requirements.

Automotive Manufacturing

Automotive plants were early adopters of robotics and remain among the most automated environments. Robots handle welding, painting, assembly, and material handling at massive scale.

Electronics and Semiconductor Manufacturing

Precision, cleanliness, and speed are critical in electronics production. Automation enables micro-level accuracy and contamination control.

Food and Beverage Processing

Robots perform packaging, palletizing, sorting, and inspection while meeting strict hygiene standards.

Pharmaceuticals and Medical Devices

Automation ensures precision, traceability, and compliance with regulatory requirements.

Logistics and Warehousing

Robotic palletizers, autonomous mobile robots, and automated storage systems streamline distribution operations.

Case Example: A Global Industrial Robotics Leader

Companies such as Yaskawa Motoman illustrate how industrial robotics firms operate on a global scale. These organizations typically combine:

Decades of engineering expertise

Large-scale robot manufacturing

Advanced motion control technology

Global service and support networks

Such companies often maintain U.S. headquarters, R&D centers, and manufacturing facilities that support customers across automotive, aerospace, consumer goods, and general industry markets.

Their solutions go beyond selling robots; they provide complete automation ecosystems, including training, system integration support, and lifecycle services.

Integration: Turning Robots Into Working Systems

A robot alone does not create Industrial Robotics and Automation either work directly with manufacturers or partner with system integrators to build complete production solutions.

Automation Cell Design

An automation cell includes robots, tooling, safety fencing, conveyors, sensors, and control systems configured to perform a specific task.

Safety Systems

Modern automation emphasizes safety through:

Light curtains and scanners

Emergency stop systems

Collaborative robot features

Compliance with international safety standards

Testing and Commissioning

Before deployment, systems are tested through simulations and real-world trials to ensure reliability and performance.

Digital Transformation and Smart Factories

Industrial robotics and automation companies are increasingly central to the rise of smart factories.

Industrial IoT (IIoT)

Connected robots and machines collect data that can be analyzed to improve performance, predict failures, and reduce downtime.

Digital Twins

Digital replicas of production systems allow manufacturers to simulate changes, optimize layouts, and test new processes without disrupting operations.

AI and Machine Learning

Artificial intelligence enables adaptive robotics, predictive maintenance, and smarter decision-making across the production line.

Workforce Impact and Skills Evolution

Contrary to common misconceptions, automation does not eliminate jobs—it transforms them.

New Roles Created by Automation

Robot programmers

Automation engineers

Maintenance technicians

Data analysts

System integrators

Industrial robotics companies often provide training programs to help workers transition into higher-skill roles.

Challenges FacingIndustrial Robotics and Automation

Despite rapid growth, the industry faces challenges:

High upfront costs for small manufacturers

Integration complexity

Cybersecurity risks

Need for skilled personnel

Leading automation companies address these challenges by offering modular systems, collaborative robots, improved software usability, and strong customer support.

The Future of Industrial Robotics and Automation

The future of Industrial Robotics and Automation is defined by flexibility, intelligence, and collaboration.

Key trends include:

Collaborative robots (cobots) working alongside humans

Autonomous mobile robots (AMRs) for internal logistics

AI-driven adaptive automation

Greater accessibility for small and mid-sized manufacturers

As these technologies mature, automation will become more customizable, affordable, and widespread.

The “Agentic” Shift: From Automation to Autonomy

The most significant evolution in 2026 is the transition from Automated systems to Autonomous (Agentic) AI.

The Old Paradigm (Automated): A robot follows a rigid script. If a sensor detects an error, the robot stops, an alarm sounds, and a human technician must intervene to clear the jam or reset the code.

The New Paradigm (Autonomous): An AI Agent—a digital “brain” overseeing the robot—detects a vibration anomaly in a motor. Before a failure occurs, the agent queries the ERP (Enterprise Resource Planning) system, identifies a gap in the schedule, creates a maintenance ticket, and re-routes production to an alternative line—all without human input.

Key Trend: 2026 is the year of “AgenticOps,” where digital workers autonomously manage the lifecycle of a production floor, leaving humans to supervise policy and risk rather than day-to-day mechanics.

Physical AI and the Humanoid Era

We are witnessing the first major wave of Humanoid Robots entering brownfield (existing) facilities. Unlike traditional arms that require a factory to be built around them, humanoids are built for spaces designed for humans—capable of navigating stairs, narrow aisles, and using standard manual tools.

Why Humanoids in 2026?

Versatility: One robot can transition from unloading a truck to sorting inventory and then to basic machine tending.

Ease of Deployment: They don’t require the extensive safety fencing of articulated robots.

Sensor Fusion: By combining mmWave radar (which works in total darkness or dust) with LiDAR and 3D Vision, these robots possess a “spatial intuition” that allows them to predict human movement and avoid collisions before they happen.

The “Simulate-then-Procure” Economy

The high cost of capital in 2026 has ended the era of “CapEx guessing.” Companies no longer buy robots based on brochure specs. Instead, they use a Digital Twin-First approach.

Virtual Commissioning: Engineers build the entire robotic cell in a high-fidelity 3D simulation.

Physics-Based Validation: The simulation tests the robot’s stress points, energy consumption, and cycle times using real-world physics.

ROI Certainty: A company can verify that a specific cobot will provide a 14-month ROI before a single bolt is turned on the factory floor.

Redefining the Workforce: The “Skill Change Index”

As automation handles more “blunt force” tasks, the role of the industrial worker is being fundamentally redesigned.

The 2026 Talent Gap

There is a massive shift in demand for specific skill sets:

Declining Demand: Manual data entry, basic machine operation, repetitive sorting, and rote quality inspection.

Surging Demand: AI Fluency (the ability to manage AI agents), Robot Coordination, Predictive Maintenance Analysis, and Human-Machine Interface (HMI) Design.

| Skill Category | 2026 Status | Impact of Automation |

| Technical Maintenance | Critical Shortage | Moving from “fixing” to “preventing” via data. |

| Data Orchestration | High Growth | Managing the flow of data between robots and the cloud. |

| Soft Skills (Empathy/Ethics) | Essential | Managing the ethical implications of AI and leading teams. |

Sustainability and the “Circular Robot”

In 2026, ESG (Environmental, Social, and Governance) mandates are no longer optional. Industrial Robotics and Automation are now judged on the “greenness” of their automation.

Energy-Optimized Pathing: AI now calculates the most energy-efficient movement path for a robotic arm, often reducing power consumption by up to 20%.

Life-Cycle Assessments (LCA): Major manufacturers (like ABB and KUKA) have launched “buy-back” programs for old robots, refurbishing and reselling them to smaller enterprises to promote a circular economy.

Waste Reduction: Automated high-precision cutting and 3D-vision-guided sorting have reduced material waste in the textile and food industries by an average of 15%.

Cybersecurity in a Connected Plant

With robots now “open by default” via APIs and 5G, the Cyber-Physical Attack Surface has expanded.

The Threat: Hackers targeting the movement parameters of a robot, which could cause physical damage or safety hazards.

The 2026 Solution: Zero-Trust Architecture at the Edge. Each robot has a unique digital identity, and every command must be verified by an encrypted gateway before execution.

Summary: Your 2026 Roadmap

If you are leading an industrial robotics and automation company, your focus should be on:

Interoperability: Don’t build “walled gardens.” Use open protocols like OPC UA so your robots can talk to any AI platform.

Agentic Integration: Move your software focus from “remote control” to “autonomous agents.”

Human-Centricity: Invest as much in upskilling your clients’ workforces as you do in the hardware itself.

Conclusion

The era of industrial robotics and automation has moved past the “futuristic” phase and into a period of mature, intelligent execution. As AI continues to provide robots with better “vision” and “judgment,” the boundary between human and machine capabilities will continue to blur, leading to more resilient, efficient, and safer global industries.